-p-800.jpg)

30 in 2025: The cultivated meat stories that actually moved the industry forward

Here's 30 stories from 2025 that show how cultivated meat continued to advance across regulation, scale-up, and commercialization

Two company closures late in 2025 grabbed the oxygen. They drove the loudest takes, the cleanest narratives, and the easiest 'told you so' headlines. But cultivated meat did not stand still this year. In fact, 2025 looked like a sector learning to operate like an industry: picking sensible first markets, leaning into ingredients and hybrids, investing in scalable inputs, and building real regulatory and manufacturing pathways.

Our 2025 roundup that follows below stayed deliberately focused on the positive developments that often got buried beneath the noise. It was the quieter progress that, over time, decided whether cultivated meat stayed a science project or matured into a category.

What follows are 30 stories from 2025 that helped push that arc forward...

UMAMI Bioworks reframed cellular agriculture as ethical luxury with cultivated caviar

January 21, 2025

UMAMI Bioworks opened the year by aiming at a category that made strategic sense: high-value luxury food where sustainability and ethics were not just marketing, but pressure points. With sturgeon populations under severe strain and conventional caviar production tied to invasive extraction, the company pitched cultivated caviar as a way to protect ecosystems without giving up the sensory experience.

CEO Mihir Pershad connected the project to a changing consumer zeitgeist, remarking. “Traditional caviar production has significant ecological and ethical impacts. At UMAMI Bioworks, we’re offering a solution that combines culinary excellence with responsibility.” Product Manager Gayathri Mani leaned into the same positioning, adding, “By addressing ethical and environmental concerns, we’re reshaping luxury for a new generation of consumers who value sustainability.”

The broader significance was that cultivated seafood innovation in 2025 increasingly targeted 'premium but plausible' first steps, rather than trying to win commodity markets out of the gate.

Stämm and SuperMeat brought continuous bioprocessing into cultivated chicken scale-up conversations

February 4, 2025

Stämm and SuperMeat announced a partnership that reflected a growing shift in cultivated meat: borrowing hard-won industrial logic from biopharma and applying it to food. The focus was integrating Stämm’s bubble-free continuous bioreactor into SuperMeat’s production workflow, with mutual investor Varana Capital supporting.

Stämm CEO Yuyo Llamazares Vegh described the collaboration as a meaningful validation step, stating, “This partnership marked a pivotal moment in the evolution of cultivated meat biomanufacturing.” SuperMeat CEO Ido Savir emphasized the value of interoperability across disciplines, noting, “This partnership demonstrates how complementary technologies can accelerate progress in the cultivated meat industry.”

The significance was less about any single pilot run and more about a broader industry reality: continuous processing and higher volumetric productivity were becoming serious topics, not theoretical ones.

Meatly and THE PACK delivered Europe’s first cultivated meat sale through pet food

February 6-7, 2025

Europe’s first commercial sale of cultivated meat arrived not via a restaurant menu, but a Pets at Home store in Brentford. Meatly and THE PACK launched Chick Bites, positioning pet food as a pragmatic route where consumer novelty could meet manageable regulatory and commercial complexity.

Meatly CEO Owen Ensor captured the historical weight directly: “We’ll also be the first company in Europe ever to sell cultivated meat (for humans or pets). Cultivated meat can be a game-changer for us, our pets, and the planet, and the starting point is today.” THE PACK CEO Damien Clarkson placed the technology in a bigger ethical frame, commenting, “Cultivated meat offers a tasty, low-carbon, and healthy protein source, which has the potential to eliminate farmed animals from the pet food industry.”

The wider point was that 2025 repeatedly showed cultivated meat did not need to win human food first in order to prove it could reach real customers.

Re:meat raised €1m to build a 'Re:meatery' before evolving into Curve

March 13, 2025 (and November 10, 2025 rebrand)

In March, Swedish startup Re:meat closed an oversubscribed €1 million round to pursue a modular, brewing-inspired production model and to establish Scandinavia’s first 'Re:meatery'. The pitch was cultivated meat as distributed manufacturing, built to fit into existing food infrastructure.

CEO Jacob Schaldemose Peterson anchored the argument in resilience, warning that future protein supply would be tested by shocks and instability. He stated: “Readiness in times of crisis starts with resilient food systems… we are building a future where nations are better prepared, more self-sufficient, and ready to face whatever geopolitical or climate-related challenges lie ahead.”

In November, the same team rebranded as Curve and broadened its mission beyond cultivated meat into industrial protein biomanufacturing more generally. Peterson commented, “Scaling biotech is the next industrial revolution – but it demands tools built for this century, not the last.” Investor and board member Torbjörn Sahlén explained the strategic logic: “Experience showed that if we focused exclusively on that, we were not maximizing our ability to scale and left significant potential untapped.”

The story mattered because it reflected a 2025 pattern: some cultivated meat startups shifted toward enabling infrastructure rather than single-product bets, without abandoning the underlying goal of cost-efficient production.

BioCraft cleared a key EU regulatory hurdle for cultivated pet food ingredients

March 25, 2025

BioCraft Pet Nutrition secured official registration in Austria to use Category 3 Animal Byproducts in the EU, establishing itself as a Feed Business Operator and clearing a practical path to commercialization for cultivated pet food ingredients across the bloc.

Founder and CEO Dr Shannon Falconer highlighted how far the company went beyond baseline compliance, commenting: “This comprehensive safety analysis goes well beyond regulatory compliance and provides a meticulous breakdown of our feed safety protocols.” Industry validation also came from the manufacturing side. Patricia Heydtmann, Quality & Product Development Director at Partner in Pet Food, noted: “Pet food producers were following this market space eagerly… BioCraft’s HACCP plan detailing safety and nutritional quality provided an additional assurance.”

The significance was that Europe already had usable, scalable routes for cultivated pet nutrition, even as human food approvals remained slower.

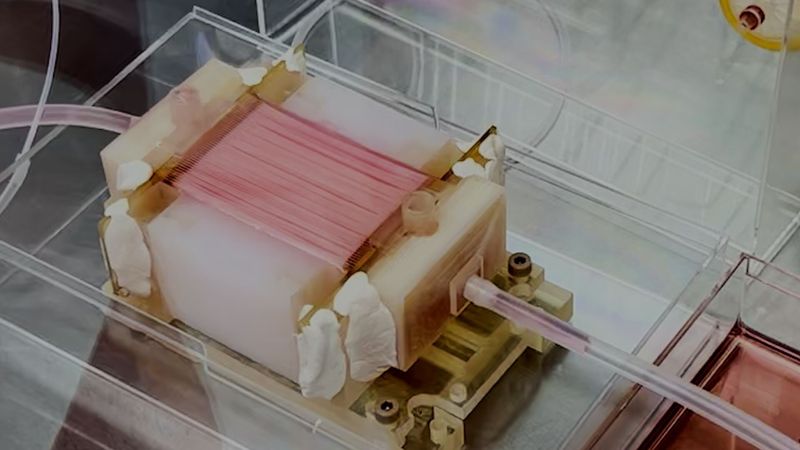

University of Tokyo researchers pushed whole-cut production toward scalable bioreactor design

April 22, 2025

A team at the University of Tokyo demonstrated a platform for centimeter-scale, perfused whole-cut production using hollow fiber bioreactors arranged in a uniform microfabricated lattice. The work aimed squarely at one of cultivated meat’s hardest problems: consistent, thick tissue without necrosis.

Professor Shoji Takeuchi described the intention plainly. “Our goal was to develop a scalable, automated method that maintained cell viability and enabled the production of muscle tissues with consistent alignment, structure, and function.” Beyond viability, the team reported improvements in texture and the chemistry tied to taste, suggesting bioreactor engineering could shape sensory outcomes, not just scale metrics.

In a year where much of the narrative centered on cost and capital, this story was a reminder that whole-cut realism still depended on deep technical advances.

Mosa Meat entered the UK sandbox with cultivated beef fat as a first commercial step

May 15, 2025

Mosa Meat submitted its first UK market authorization request, focusing on cultivated beef fat for hybrid products. The strategy aligned with 2025’s strongest commercial logic: fat as a low-inclusion, high-impact ingredient that could deliver taste improvements without requiring 100% cultivated products at launch.

CEO Maarten Bosch credited the FSA’s engagement and framed the sandbox as a practical accelerator for innovation. He commented: “We were thankful to the Food Standards Agency for engaging in valuable presubmission consultations… the regulatory sandbox was already making an impact on attracting innovative companies like ours to the UK market.” He also articulated the product rationale, describing fat as “the soul of flavor.”

The significance was that the UK’s sandbox began to look like more than a concept. It started to function as a real on-ramp for dossiers.

Meatly cut bioreactor and media costs and tightened the case for pet food as the first market

June 2, 2025

Meatly followed its February launch momentum by detailing technical progress aimed at reaching price parity in pet nutrition. The company reported a patent-pending bioreactor system it described as 20 times cheaper than conventional models, and animal-free growth medium costs reduced to £0.22 per liter, with potential to fall even lower at scale.

Ensor underlined the human capital behind the strategy, remarking: “Dr Cruz had a huge wealth of scientific knowledge… and I’m blending my love for animals… with experience scaling and advising businesses in alt-proteins.” Cruz set the economic north star bluntly: “By reaching price parity, it then becomes a simple and easy choice for consumers to buy better meat for their pets.”

The wider significance was that pet food remained one of the clearest “proof of market” paths in 2025, combining regulatory feasibility with consumer willingness to pay for premium health narratives.

Wildtype became the first cultivated seafood cleared for US sale and served in a restaurant

June 3, 2025

Wildtype’s cultivated salmon became the first cultivated seafood available to consumers worldwide after the FDA issued a 'no questions' letter on 28 May. The product made its debut at Kann in Portland, one night a week in June, with plans for wider service.

The FDA letter itself was unusually direct, concluding: “We did not identify a basis for concluding that the production process… would be expected to result in food that bears or contains any substance or microorganism that would adulterate the food.” Chef Gregory Gourdet emphasized ingredient integrity, stating: “Introducing Wildtype’s cultivated salmon… hit the elevated and sustainable marks we wanted.”

From the industry side, AMPS Executive Director Dr Suzi Gerber described it as a “watershed moment”. The significance was twofold: seafood continued to move faster than terrestrial meat in US commercialization, and restaurant launches remained the sector’s preferred mechanism for controlled early exposure.

Korean researchers recreated marbled cultivated beef texture using a self-healing scaffold

June 10, 2025

South Korean scientists reported a scaffold that enabled muscle and fat tissues to be grown separately and assembled into marbled structures, improving the realism of cultivated cuts. The team stated, “Muscle or fat cells could be cultured separately on the scaffold, and then assembled like Lego blocks to easily realize marbled tissues.”

The work addressed a persistent critique: cultivated meat too often looked like uniform biomass rather than complex tissue. The scaffold’s performance during cooking added practical relevance, suggesting texture breakthroughs could become manufacturing breakthroughs if they remained affordable and adaptable.

In the context of 2025, this story contributed to a larger theme: the industry’s credibility depended not just on being sustainable, but on delivering sensory performance consumers recognized instantly.

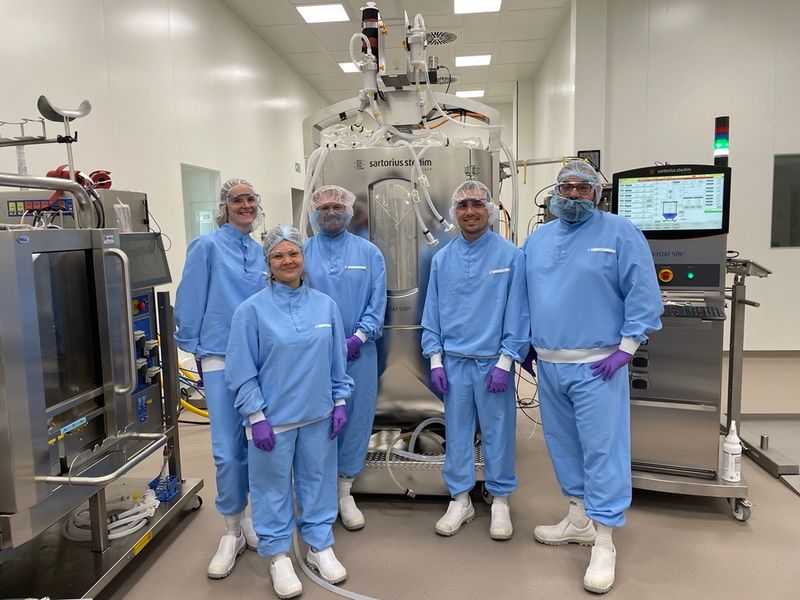

Cultivate at Scale and Sartorius expanded shared pilot infrastructure in Maastricht

June 16, 2025

Cultivate at Scale announced a bioprocessing collaboration with Sartorius, including installation of a 1,000L single-use bioreactor. For startups stuck between lab work and pilot-scale reality, shared infrastructure became a pivotal enabling layer in 2025.

Managing Director Jaco van der Merwe explained the facility’s purpose: “We measured success as the extent to which we could help our customers develop their processes and reach the next level of scale.” He emphasized flexibility across scales and a cleanroom operating model, adding that while it was not a regulatory requirement, it minimized contamination risk.

The significance was that the ecosystem started to build more of the “middle layer” facilities needed to bridge R&D and commercial manufacturing, rather than leaving each startup to reinvent that capacity alone.

Vow secured Australian approval for cultivated quail and doubled down on scale

June 18, 2025

Australia approved Vow’s cultivated Japanese quail, adding another major jurisdiction to the country list and supporting multi-market sales. CEO George Peppou framed the approval as both cultural and commercial, stating: “To now be able to offer something completely new – not an imitation, but a new category of meat – is something we were incredibly excited about.”

Chef Mike McEnearney reinforced Vow’s product-first positioning, commenting: “This isn’t about replacing the meats we know and love. It’s about trying something entirely new – something that can only exist because of how it’s made.” Vow also highlighted scale milestones, including large harvest volumes and big reactor capacity, which mattered in a year where investors demanded operational credibility.

The significance was that the 'new category' framing found regulatory validation and real venue uptake, not just branding.

Clever Carnivore argued that cost parity was possible with extreme capital efficiency

June 26, 2025

Chicago-based Clever Carnivore described a cultivated pork platform built around low media costs, fast-growing porcine cell lines, and a deliberately lean factory model. Co-founder Dr Paul Burridge captured the company’s ethos memorably: “Necessity is the mother of invention… describing our team as scrappy didn’t begin to cover it.”

He also delivered one of the year’s most quoted cost datapoints, stating: “US$0.07 per liter was our current real-world cost of our food-grade cell culture media.” The company framed this as the kind of tangible input reduction that shifted cultivated meat from “possible” to “buildable.”

In 2025’s funding climate, the story mattered because it offered a counter-narrative: progress did not always require huge raises, but it did require ruthless focus on unit economics.

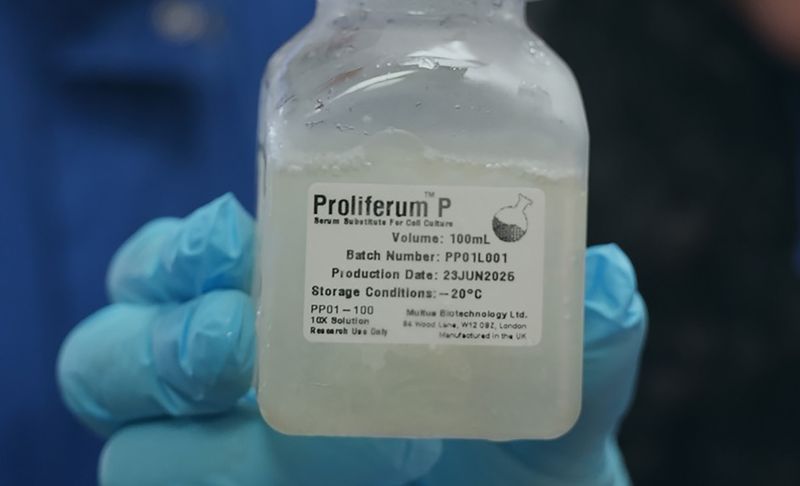

Multus launched Proliferum P, compressing serum replacement development into months

June 30, 2025

Multus Biotechnology launched Proliferum P, an animal component-free serum replacement designed for porcine adipose-derived stem cells, developed in under six months. Dr Soraya Padilla stated: “Traditional approaches typically took two to four years to develop serum replacements.”

CEO Cai Linton framed the platform’s promise as continuous improvement, commenting: “Our platform doesn’t just allow us to match industry standards – it ensures we continuously raised the bar.” Supply chain lead Julian Arjuna Bisten emphasized market flexibility, noting Proliferum P was designed “for use across multiple sectors,” including regenerative medicine.

The wider significance was that upstream media innovation accelerated in 2025, supporting cultivated meat indirectly by lowering foundational costs and reducing development timelines.

VAN HEES and BLUU Seafood signaled ingredient-industry buy-in for hybrid cultivated fish

July 8, 2025

German ingredient specialist VAN HEES partnered with BLUU Seafood to develop hybrid products blending plant components with cultivated fish cells. Robert Becht, Managing Director of VAN HEES Group, commented: “We saw great potential in cultivated fish as part of a sustainable protein supply.”

BLUU’s Managing Director Dr Sebastian Rakers highlighted the mutual benefits, stating: “Both sides… could only benefit from this partnership.” The significance was that legacy ingredient players increasingly treated cultivated seafood not as a fringe experiment, but as a future formulation domain where their expertise in taste, stability, and safety would be decisive.

Mission Barns gained USDA approval and cleared a path for cultivated pork fat in US products

July 24, 2025

Mission Barns secured USDA approval for its cultivated pork fat, including facility inspection approval and labeling clearance. Chief Business Officer Cecilia Chang described the moment as validation, commenting: “This approval validated our core technology and opened the door to deeper collaborations.”

She also emphasized the company’s bioreactor strategy, stating: “This isn’t just repurposed pharma equipment. It’s a food-grade, cost-sensitive system… purpose-built to support high-volume, low-cost fat production.” The story also explored political headwinds at the state level, but the regulatory milestone itself underscored a key 2025 truth: federal agencies were capable of approving cultivated products, even as some local politics moved the other way.

Friends & Family became the first company approved for cultivated meat pet food in Asia

July 28, 2025

Singapore’s AVS approved Friends & Family for cultivated meat-based pet treats, a first for Asia. COO Maurice Yeo remarked: “This is a big step for the cultivated meat industry, and for Singapore.”

Founder and CEO Joshua Errett framed the mission as nutritional improvement, not just ingredient replacement: “Part of the Friends & Family mission was not simply to replace the protein… but to improve the underlying protein cats and dogs eat.” He described pet food as uniquely testable, noting: “Pet food was straightforward… you can feed a cat the same food every day… and get very clear data.”

The significance was that pet food continued to act as both a commercialization beachhead and a scientific validation channel.

Atlantic Fish Co secured NSF SBIR funding to scale cultivated black sea bass

August 4, 2025

Atlantic Fish Co received a US$305,000 NSF grant to support scale-up work in cultivated seafood. CEO Doug Grant framed it as technical validation, stating: “This NSF award is more than just capital – it’s validation from rigorous scientific reviewers.”

With total non-dilutive funding exceeding US$700,000, the story reflected how early-stage cultivated seafood companies increasingly relied on grants to progress through foundational R&D during a tighter private capital environment.

-p-800.jpg)

Mewery raised €3 million to push co-cultivated meat toward industrial testing

August 5, 2025

Czech startup Mewery secured €3 million to advance its hybrid animal cell and microalgae platform toward industrial-scale testing. Founder and CEO Roman Lauš described the grant as a bridge from science to meaningful commercial readiness: “Thanks to European grants, we were able to focus all our efforts on research and development… It enabled scientific development to reach a stage where it made sense for commercial scaling.”

He also framed upcoming pilot work as the critical next step: “This will be a crucial step that will open the way for us to test our technology with meat producers.” The significance was that Europe’s public funding mechanisms continued to pick winners based on technical credibility, even as venture appetite remained cautious.

Magic Valley partnered with Pythag Tech to use AI as a scale-up lever

August 7, 2025

Magic Valley partnered with Pythag Tech to integrate machine learning into its scale-up workflows. CEO Paul Bevan commented: “We’re using AI to unlock real-time precision, cut costs, and reach scale faster – all without compromising our values or product integrity.”

Pythag CEO Sami Nabulsi described the partnership as part of a broader industry transition, stating: “Cultivated meat companies needed to move beyond science projects into scalable systems.” In 2025, “AI” was often used lazily in food tech. This story stood out because it tied machine learning to specific manufacturing challenges: optimization, replication across reactor sizes, and cost per kilogram.

-p-800.jpg)

Aleph Farms’ independent TEA attempted to reset the profitability conversation

September 2, 2025

Aleph Farms published an independent techno-economic analysis by Eridia validating its cultivated whole-cut economics using existing technologies. The company emphasized it “was not a theoretical nor academic exercise,” describing it as “an industrial-grade study.”

The study’s headline figures were strong: production costs and gross margins that suggested profitability could be achievable without speculative mega-reactors or unproven breakthroughs. In a year dominated by skepticism, TEAs like this mattered because they shifted the debate from “can it ever work?” to “what assumptions need to hold, and where are the cost levers?”

ORF Genetics raised €5 million to scale barley-based growth factors and lower key input costs

September 10, 2025

ORF Genetics raised €5 million to expand production of its growth-factor portfolio, with plans to increase capacity dramatically over time. Co-founder and CSO Dr Björn Örvar explained the original platform rationale, stating: “From the outset, our vision was to use plants to produce unique proteins… We chose barley because of its natural advantages.”

He also acknowledged the early market resistance to lower-purity growth factors, recalling: “When we launched… in 2020, it was a tough sell.” The company overcame skepticism through sampling and collaboration, and Örvar praised one partner directly: “We’re proud to be part of Vow’s journey… They’re an incredible company with a bold vision.”

The significance was that input suppliers in 2025 increasingly looked like the missing link between pilot success and commercial cost targets.

GFI and Tufts turned a startup closure into open-science infrastructure for the field

October 20, 2025

GFI acquired key bovine cell lines and serum-free media developed by SCiFi Foods and partnered with Tufts to make them publicly available, marking the first time suspension-adapted bovine cell lines were released for open use.

Dr Amanda Hildebrand, GFI’s VP of Science & Technology, called it “a pivotal moment for open science in cellular agriculture,” and used a relay metaphor to underline knowledge preservation: “GFI was uniquely able to ensure that baton didn’t drop.”

Tufts’ Dr Andrew Stout highlighted why shared scalable systems mattered: “When labs across the field had access to shared, scalable, and serum-free systems… it will cause a real leap in the value and applicability of R&D.” Joshua March, SCiFi’s co-founder and CEO, described the difficulty of what was being preserved: “It took us four years and tens of millions of dollars to develop these cells…”

The significance was that 2025 showed the sector could recycle technical progress even when companies closed, rather than losing it to auctions and silence.

PARIMA became Europe’s first company approved to sell cultivated meat for humans

October 28, 2025

PARIMA secured Singapore approval for cultivated chicken, becoming the first European company cleared to market cultivated meat for human consumption. CEO Nicolas Morin-Forest framed it as validation of platform fundamentals, commenting: “This approval is a testament to our approach… It validates the safety and robustness of the core foundation of our multi-species platform.”

Etienne Duthoit, founding member of Cellular Agriculture Europe and founder of Vital Meat, described it as “a landmark for European food innovation and the global cultivated foods sector.”

The significance was that Europe’s cultivated meat capability showed up in the world’s most established cultivated-meat regulatory market, signaling that “European leadership” could be measured in approvals, not just ambition.

Hoxton Farms filed in Singapore for cultivated pork fat and mapped a global regulatory sequence

November 4, 2025

Hoxton Farms submitted a dossier to the Singapore Food Agency for its cultivated pork fat and positioned the filing as the first in a sequence spanning the UK, North America, and additional Asian markets.

Co-founder and CEO Max Jamilly described Singapore’s regulatory maturity, stating: “The SFA remains a world leader in regulation for cultivated products… their commitment to safety, transparency and collaboration hasn’t changed.” He also detailed the company’s technical focus, emphasizing: “Not only were we making real fat tissue… but our proprietary cell lines, optimized bioprocess and patented bioreactors were all designed for cost efficiency and scale.”

Jamilly also articulated the ingredient strategy succinctly: “Fat is what makes food taste delicious… a low inclusion, high-impact ingredient.”

The significance was that by late 2025, more companies treated regulatory planning as a multi-market pipeline rather than a single make-or-break event.

Hebrew University researchers reported naturally immortal cow cells without genetic modification

November 13, 2025

Researchers at the Hebrew University of Jerusalem reported that bovine cells could become naturally immortal without genetic modification, published in Nature Food. The work was conducted in collaboration with Believer Meats at the time, but the scientific significance stood independent of any single corporate partner, especially given the company’s later closure.

Professor Yaakov Nahmias described how persistence overturned conventional wisdom: “The consensus in the field was that bovine cells could not do the same… We had to continuously culture bovine cells for more than 18 months before the first self-renewing colonies emerged.” He later captured the emotional payoff: “Then, after over 400 silent days, colonies suddenly appeared, a true ‘eureka’ moment…”

Dr Elliot Swartz, Senior Principal Scientist for Cultivated Meat at The Good Food Institute, framed it as a roadmap for non-GM cell line development: “This study… marks an exciting advance… it provides a roadmap for non-GM approaches to be used for commercially cultivated meat production.”

The significance was that beef remained the hardest species challenge for cost and scalability. Any advance that reduced reliance on gene editing and eased regulatory concerns was meaningful field-wide.

RespectFarms launched the world’s first cultivated meat farm on a working dairy site

November 22, 2025

RespectFarms and Dutch dairy farmer Corné van Leeuwen unveiled what they described as the world’s first cultivated meat farm, integrating cultivated meat production units into an operating dairy farm in Zuid-Holland.

Co-founder Ira van Eelen defined the model as farmer-centric, stating: “We’re building a model where livestock farmers remain at the centre of food production, not replaced by factories.” Van Leeuwen tied the experiment to farm survival and diversification, commenting: “As a farmer you have to look ahead… Not trying it would be a missed opportunity.”

Regional Minister Meindert Stolk framed the initiative as a milestone for the province, noting: “With RespectFarms, Zuid-Holland is setting a world first.”

The significance was that cultivated meat typically looked like centralized, industrial manufacturing. This story proposed a different economic narrative: “scale-out,” distributed production, and farmers as operators rather than bystanders.

SuperMeat raised fresh capital as it pursued European launch and cost parity narratives

November 24, 2025

SuperMeat raised US$3.5 million in new funding to support cultivated chicken rollout in Europe, with Agronomics leading. Agronomics Executive Chair Jim Mellon framed the rationale in sustainability and protein demand terms, stating: “As global demand for protein continues to rise, it is essential to meet this demand sustainably…”

SuperMeat CEO Ido Savir linked the funding to commercialization, commenting: “Over the past year we have made substantial advancements… making cultivated chicken production commercially viable, and were now focused on translating these achievements into commercial launch.” He also described the company’s long-term ambition: “Our vision is to make cultivated meat a mainstream choice…”

He also emphasized multidisciplinary collaboration, remarking: “Introducing a new industrial production process highly benefits from innovation and experience in multiple disciplines.”

The significance was that late 2025 saw cultivated meat companies increasingly forced to pair technical claims with credible financing structures and near-term commercial plans.

Fork & Good, Extracellular, and Nutreco aligned on media, bioprocess, and supply chain foundations

December 4, 2025

Fork & Good, Extracellular and Nutreco announced a strategic partnership focused on high-performance media, biomanufacturing capabilities, and supply-chain readiness.

Gabor Forgacs captured the industry-wide challenge bluntly: “It is just damn difficult to make cell-cultivated meat economically alone.” Extracellular founder Will Milligan emphasized integrated capability building, commenting that Extracellular was “proud to be working alongside two leaders… bringing together exceptional cells, media and bioprocess capabilities.” Nutreco’s Vincent Krudde linked the collaboration to corporate mission, stating: “This collaboration underpins Nutreco’s continued commitment to Feeding the Future.”

The significance was that, by December, the sector’s most credible progress stories increasingly involved partnerships that stitched together the value chain, rather than isolated breakthroughs.

FSA and FSS published the UK’s first safety guidance for cell-cultivated products

December 9, 2025

The Food Standards Agency and Food Standards Scotland published the UK’s first safety guidance for cell-cultivated products, the first output of the Cell-Cultivated Products Sandbox Programme. The guidance clarified how existing rules applied to animal-cell-derived foods and confirmed they fell under the definition of products of animal origin.

Dr Thomas Vincent, Deputy Director of Innovation at the FSA, described the purpose in terms of clarity and consumer reassurance, stating: “Our new guidance provides clarity for businesses… ensuring that companies have assessed potential allergenic risks and that they are nutritionally appropriate before they can be authorised for sale.” He also emphasized the sandbox’s role: “The Sandbox Programme is allowing us to fast-track regulatory knowledge… without compromising on safety standards.”

The significance was difficult to overstate for the UK market: regulatory guidance did not equal approvals, but it reduced uncertainty, lowered the risk of dossier mistakes, and signaled that cultivated products were being treated as a serious regulatory category.

Roundup analysis: what 2025 really proved

If you only followed the loudest headlines, 2025 looked like retrenchment. But the underlying pattern was closer to consolidation and maturation.

First, cultivated meat leaned into entry points that made commercial sense. Fat, hybrid formulations, and pet food showed up again and again because they delivered outsized sensory impact, clearer consumer value propositions, and more practical regulatory and scaling pathways. Hoxton Farms, Mission Barns, and Mosa Meat all treated fat not as a compromise, but as the strategic key to taste.

Second, regulation moved from abstract debate to operational detail. The UK’s CCP guidance and sandbox outputs, Singapore’s continuing approvals, and Australia’s FSANZ decision for Vow collectively signaled that cultivated meat was not trapped in regulatory limbo. It was being processed through systems that were increasingly specific about what 'good' looked like, and that mattered for investment, partnerships, and internal technical priorities.

Third, the sector’s center of gravity shifted toward enabling layers. Multus, ORF Genetics, Cultivate at Scale, and the GFI-Tufts open-science release all pointed to the same truth: a lot of the category’s progress depended on infrastructure and inputs that served many companies, not just one. When those layers improved, the entire field benefited, and when a startup closed, its value no longer had to vanish with it.

Fourth, credibility became a numbers game. TEAs and concrete cost datapoints started to land because investors and skeptics demanded them. Clever Carnivore’s media cost claim, Aleph Farms’ TEA, ORF’s purification insight, and Meatly’s media and bioreactor figures all fed into a broader reframing: the question was no longer whether cultivated meat could ever be made, but under what economics, at what scale, and by which production philosophies.

Finally, 2025 exposed a more mature, more realistic industry psychology. Some companies broadened into platforms, as Curve did. Others partnered aggressively to de-risk scale-up and supply chains. And even when the sector faced closures, the best stories were not denial. They were adaptation: preserving knowledge, tightening strategy, and focusing on what moved the needle.

Sure, the closures grabbed attention, but they did not define the year. The story of 2025 was that cultivated meat kept building, often quietly, often imperfectly, but with a clearer sense of how it would actually reach market.

If 2024 was about survival, 2025 looked like the year cultivated meat started learning how to behave like an industry. What will 2026 hold?

If you have any questions or would like to get in touch with us, please email info@futureofproteinproduction.com

.png)